High-Frequency Trading and Macroeconomic News: Investigating Potential Information Asymmetries and The Potential Impact on Market Fairness

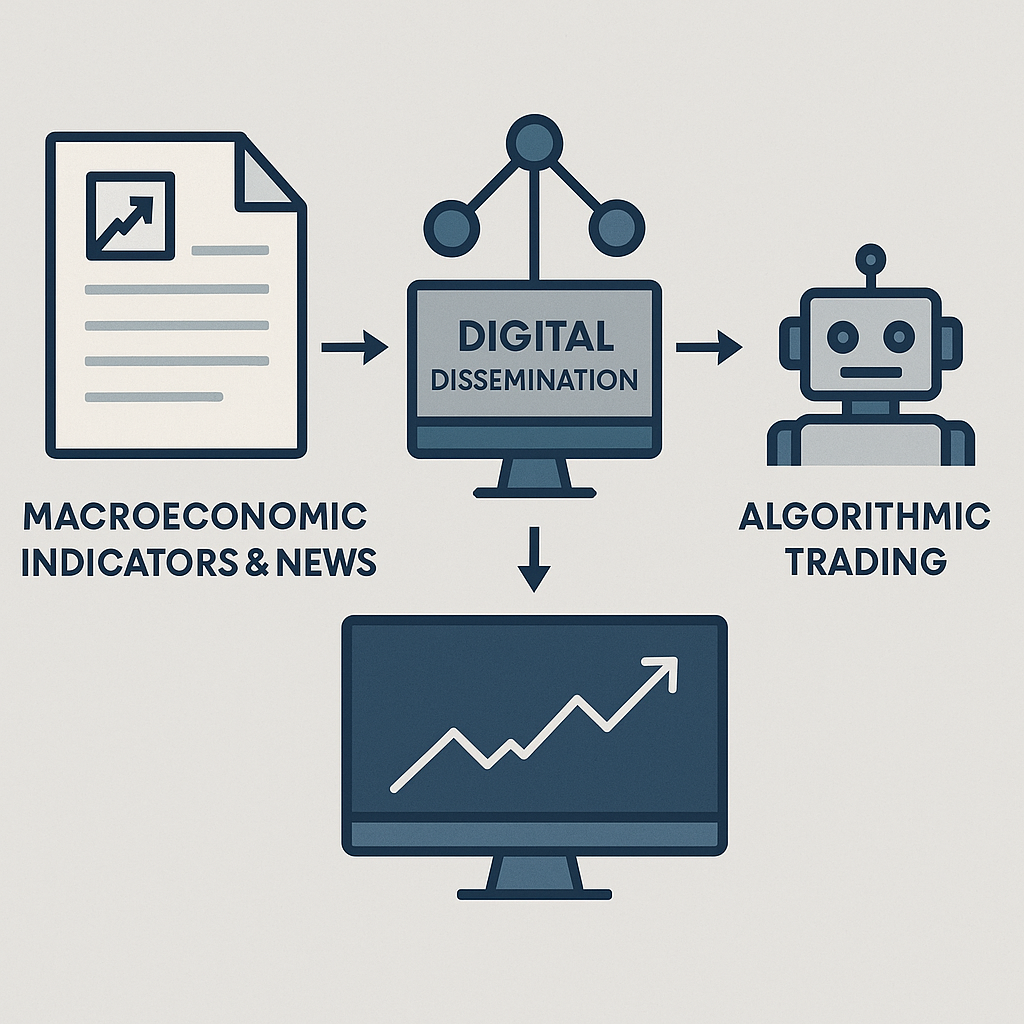

This thesis examines whether HFT firms gain unfair advantages during macroeconomic news releases due to dissemination and infrastructure. Using Deutsche Börse data, it analyzes how timing and access to FOMC, NFP, and ISM news impact trading profitability.

Topic

Relevance

Results

Implications for practitioners

- Latency-optimized infrastructure alone does not ensure trading success - news content matters.

- Regulators should reassess dissemination procedures for fairness and equal access.

- Exchanges must evaluate whether co-location and data feed services promote structural equity

- Institutional traders may benefit from focusing on strategic execution, not just speed.

- Informational content should guide HFT strategy alongside infrastructure considerations.