The Potential of Digital Assets and Tokenization for the Insurance Industry

Exploring the Key Enablers for a Digital Token Offering and Analyzing the Impact of a strong Brand on such Offerings.

Topic

As digital transformation is changing the insurance sector, new business opportunities like blockchain technology and digital token offerings need to be explored. Digital tokens have many applications, from specialized sectors like art and collectibles to offering liquidity for real estate and securities investments. Digital assets, essentially digital representations or tokens of value or rights, can be transferred, traded, and utilized for economic, investment, or other purposes. However, uncertainty remains about viable business models for these tokenized assets. This study aims to provide a first explorative understanding of the future potential of digital assets and tokenization within the insurance industry as an ecosystem strategy.

Relevance

Due to digitalization La Mobilière recognized the importance of exploring new market opportunities and relies on an ecosystem strategy to explore new markets. With traditional insurance services being disrupted, the research examines how insurance providers can leverage digital assets and tokenization to create new revenue streams. This study investigates the key factors that drive acceptance of digital token offerings and determines the role of an insurance company's reputation. By identifying these factors, we can evaluate whether a digital token offering is a viable business model for the ecosystem strategy of insurance companies.

Results

The results show that usefulness and trust are enablers for digital token acceptance. Technologically experienced individuals are more likely to perceive digital tokens as useful and trustworthy. Our findings further indicate a limited impact of perceived risk on the willingness to invest in digital tokens. The outcome suggests that accepting digital tokens is primarily about technology rather than the brand offering digital tokens.

Implications for practitioners

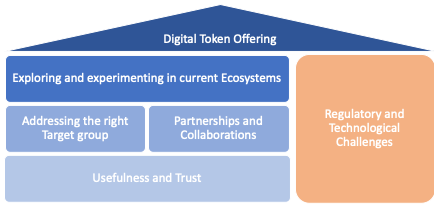

This research offers implications for companies like la Mobilière considering digital token offerings.

- We suggest focusing on a specific, tech-savvy target group, enabling the company to position itself as an innovative pioneer without convincing a broader audience.

- While digital token offerings might not provide a viable revenue source with current ecosystem strategies, gaining experience with these trends is vital. This could involve creating digital token-related prototypes with current ecosystem platforms.

- Regulatory challenges must be considered while exploring the potential of digital assets and tokenization.

- Companies should concentrate on the usefulness and trust regarding digital token offerings for a future business model and during experimental prototypes.

Methods.

The Technology Acceptance Model (TAM) is used to understand how people use new technologies and what influences their acceptance. This study proposes a contextualized model for digital tokens, with factors such as perceived usefulness, perceived risk, perceived trust, and the issuing company's reputation playing key roles in the acceptance of digital tokens. This study evaluated the TAM for digital tokens using a comprehensive survey. We collected the data through two different channels with the some questionnaire. The first was distributed via la Mobilière's active customer panel, and the second on the Qualtrics platform through social media. Overall, we gathered 154 valid responses. The data analysis involved two steps. Initially, we used Microsoft Excel for preliminary evaluation, followed by Partial Least Squares Structur-al Equation Modeling (PLS-SEM) to examine the relationships between the TAM factors for digital tokens.